FAQ

Q1. Why did you challenge Medallion Financial Corp. (“MFIN” or the “Company”) through a proxy contest?

We are long-term investors with substantial investment exposure to MFIN and have been invested for over 4 years. After closely analyzing 2023 SEC filings by MFIN, by 2Q23 we detected several worrying trends and felt that MFIN was heading down the wrong path. Our analysis led us to believe that there was a high probability of a substantial decline in the value of MFIN’s debt and equity if it didn’t make important changes to its governance approach and management team and focus on improving CORE⁹ business performance, which had declined. We fundamentally believe that MFIN has a business that can thrive and create tremendous shareholder value in the long run if it is run the right way. If that happens, we plan on increasing our equity ownership over time.

Q2. Couldn’t you have privately tried to find a solution with MFIN?

That was our preferred approach. We first raised our concerns in October 2023 in a 28-page analysis we shared with management and the board. We provided supporting data and asked for feedback to correct anything inaccurate. That analysis forms the basis of our “5 Steps to Improvement”. After 2 months of fruitless conversations with MFIN, we told them that we were still very concerned about the Company’s future (1 to 5 years out) and that the only option we saw to implement change was via board representation through a proxy contest. We began acquiring common stock in December 2023. We did not go public with any of our concerns, or with our notice that we intended to nominate alternative directors, because we wanted to maintain a collaborative dialogue with management which we told MFIN repeatedly in late December 2023/early January 2024. Management instead informed us on February 1, 2024 that our actions were viewed as “hostile” and that MFIN did not “intend to continue those discussions unless and until the notice is withdrawn.” We eventually went public with our campaign for change on April 12, 2024, 6 months after we first approached MFIN.

Q3. But you’re a large debt holder AND an equity holder, are you really looking out for shareholder interests?

Our goal is for MFIN to be wildly successful and increase in value. We are absolutely aligned with shareholder interests through both our debt and equity investment into MFIN. Our combined debt and equity investment in MFIN makes us one of the single largest investors in MFIN. Our debt is the most subordinated debt MFIN has or the “lowest in the capital stack”. Which means that we are the first lender to lose money if losses are catastrophic. In almost every bank failure in the last 17 years, all subordinated debt and equity has been wiped out. Our debt also has a very long maturity (2037). Because of both of those factors, the value of our debt, just like the value of your equity, is very sensitive to company performance. If the company loses money or becomes riskier because of poor business decisions, the value of our debt and the value of our equity goes down just as it does for other stockholders.

Q4. But aren’t the Mursteins also large shareholders?

Yes they are. Andrew Murstein and Alvin Murstein currently own 10% and 7.8% of outstanding shares, which would suggest aligned interests with the broader shareholder group. However, we believe that their substantial cumulative CASH compensation ($26.6 million and $14.2 million respectively from 2015 through 2023) and high cash/non-cash compensation ratio (~85%/15% cash/non-cash over that period) combined with weak MFIN stock performance (down 30% the last 10 years through 09/30/24) shows they have been able to comfortably rely on salaries and bonuses, and have been less focused on creating long-term shareholder value.¹

Q5. Wasn’t the drop in MFIN’s value back in 2015 – 2018 due to short sellers?

The decline in MFIN’s value was because it had huge charge-offs due to weak loans on its balance sheet. Short sellers might have thrown gas on the fire, but the fire was already burning. Uber came on the scene in 2011 and by 2014/5 was already a formidable rival to taxi cabs. Taxi medallion prices in NYC almost doubled from 2008 to 2014, then plummeted from their peak of over $1 million per medallion to ~$700,000 at FYE15 to under $500,000 at FYE16.¹⁶ Already stretched taxi medallion owners defaulted and since MFIN had substantial exposure to Taxi Medallion assets, it almost failed.¹⁷ In December 2014, 2 years before MFIN started writing down its Taxi Medallion loans, one short seller and several publications almost perfectly predicted the issues MFIN would face but rather than acknowledge the obvious, Andrew Murstein attacked and blamed the short sellers.¹⁸ He could have disagreed with their tactics, but he should not have disagreed with the risks they exposed. MFIN’s Taxi Medallion loans made up over 50% of their total loan book exposing them to massive concentration risk. In MFIN’s May 10, 2016 8K they stated: “…taxi medallion lending continues to have virtually zero losses…” and “[a]ll the important indicators of our business continue to demonstrate the quality of Medallion’s operations… very solid credit performance by the portfolios…” In MFIN’s November 7, 2016 8K summarizing 3Q16 results they stated: “We believe the NYC medallion industry is stabilizing” and "[t]o date, our combined actual losses in medallion lending have been just 75 basis points or $3.6 million in 2016 and were de minimis in prior years…” 55 days after their 3Q16 8K, MFIN had charged off $30.6 million in Taxi Medallion loans and non-performing Taxi Medallion loans were 21% of the portfolio. On November 1, 2016 in an internal email sent by a valuation firm that refused to provide an increased valuation for Medallion Bank an executive at the firm stated: “[W]e have ample recent evidence that medallion loans are souring (Signature Bank, BankUnited, etc.). . . . This is a strong argument for value of [Medallion] bank declining, not increasing.” Per the SEC, these asset quality concerns were shared with Murstein before the release of the November 7th, 2016 8K. An internal email between an executive and Murstein expressed serious concerns about the taxi medallion portfolio with the executive stating: “The volatility introduced by ride-share means that, in the best case, the bank only loses millions of dollars working through it. Worst case, we lose hundreds of millions-and the odds of this outcome remain too high…”

Q6. Are you concerned about the share price of MFIN?

We are very much concerned about the share price of MFIN which, at $8.14, was down 17% YTD and 30% the last 10 years through 09/30/24. There are very few direct public companies similar to MFIN but since Medallion Bank is ~95% of consolidated revenues and the bank is FDIC- insured, an appropriate comparison would be other banks, even though they are less risky and volatile than a consumer lender. Over the last 10 years, the Russell 2000 was up 102%; the KBW Regional Bank Index was up 49%; MFIN’s Peer Group Bank stocks (205 public FDIC-insured banks between $1BN and $5BN) were up 72%²; and MFIN’s own Compensation Peer Group was up (a median) 55%.³ MFIN currently trades just above tangible book value⁴ but we fear it may go below book if its loan quality issues continue. Price trends over time and MFIN’s ability to generate sustainable profits are what concern us the most because on these measures, the company is currently doing very poorly.⁵

MFIN stock price versus the KRE Regional Bank Index and Russell 2000 (10 years through 09/30/24)

MFIN stock price change vs. Proxy Peers, KRE Regional Bank Index and Russell 2000 (through 09/30/24)

Source: S&P Capital IQ. Returns through 09/30/24

FIGURE 1a AND 1b: MFIN’s stock price is down 30% over the last 10 years. MFIN stock widely trails both the Russell 2000 and its proxy peer group. MFIN likes to use 5 year and 3 year returns to show gains in its stock price. MFIN has cherry picked return periods to highlight without providing valuable context, which is not the way we believe any business should be run. For example, MFIN’s 27% returns over 5 years was fortunate timing. The 5 year price return began shortly after MFIN had its largest loss in 2018 and off a 10 year low in 2017 (excluding the COVID 2020 plunge). But this is just the price change and does not account for dividends (which regional banks paid every single quarter). Regardless, the 45% plunge in MFIN’s stock price in the first 5 years, means that it still has not made it back to break-even after 10 years.

Q7. What are the biggest risks the company is facing?

We believe that the biggest risk MFIN faces is in the subprime portion of its Recreation portfolio, which could have echoes of the Taxi Medallion loan crisis, unless the Board and management take decisive, proactive steps. Recreation loans were 63% of total loans and subprime Recreation loans were $545 million or 35% of total Recreation loans at 3Q24. We have asked for details on prime versus subprime performance and MFIN has declined to provide the information to us or through their SEC filings, but the entire Recreation segment’s charge-off rate hit a 12 year high of 4.34% or $58.2 million annualized at 1Q24 which is well ABOVE the recent cyclical peak of 3.8% at 4Q19 and is trending poorly (Figure 3 and 4 below). Quarterly charge-offs in each quarter for 2024 have exceeded their prior quarterly highs (Figure 4). The company is also facing more expensive funding, mostly through its brokered CDs, but has not been able to raise its average loan yields by much, which has reduced Net Interest Margin (“NIM”) and will hurt profits (Figure 2 below).¹⁹ MFIN must ACT NOW and work to to address these risks.

Quarterly yield on earning assets and cost of funds

Source: MFIN 10K/Qs

FIGURE 2: MFIN’s yield on its earning assets (mostly loans) has only increased by 100bps since FYE21 despite much larger benchmark rate increases. MFIN stated that the weighted average life of its loans was ~ 3 years, so its loan yields should be compared to the 3YR treasury rate. The 3YR treasury yield increased 261bps since FYE21 while MFIN’s yields only increased 90bps in the same period (at 3Q24 over 4Q21). This shows the competitive nature of consumer lending where lenders are “price takers” and cannot easily push through rate increases, unless they lend to weaker borrowers. A flat yield and increasing interest expense will cause profits to decline. 4Q22 and 4Q23 quarterly data were estimated from the average of the prior and following quarterly averages.

Recreation charge-offs

Source: MFIN 10K/Qs

FIGURE 3: Recreation loans were 63% of Total Loans at 3Q24. Losses/Charge-offs (net) were 4.34% of Recreation loans at 1Q24 and exceeded the cyclical high of 3.80% at 4Q19. All-time Recreation charge-offs peaked at 6.0% in 2009 and reached a quarterly high of 8.3% at 1Q10. Inflated collateral values due to high demand in 2021 and 2022, combined with high advance rates could result in a material increase in Recreation losses over the next 12-24 months unless MFIN is proactive with reducing risk.

Recreation charge-offs (net) by Quarter

Source: MFIN 10K/Qs

FIGURE 4: Recreation charge-offs are at their highest levels for each quarter since 2010. We expect further deterioration in 4Q24. Recreation balances at 3Q24 were $1.55 billion and at 4Q10 were $195 million.

Q8. Why is the Board so important?

The right leadership at any public company starts with having the right Board of Directors. The Board should ideally be able to provide expertise to the company to help it improve. But most importantly, the Board has a responsibility to look out for shareholders and to hold company leadership accountable. MFIN does need to appoint our nominees; we would be happy with any candidates with relevant and current skills, who are independent and who are looking out for stockholders’ interests first. We believe that MFIN and the Board do not have the necessary consumer lending and banking experience to thrive in this new consumer lending world, which is data driven, technologically-forward, constantly changing and extremely competitive. The current average Board age 75 with 3 of 8 directors Murstein family members .

Q9. What is an example of what the Board is not doing well?

We believe the Board is failing MFIN’s shareholders on multiple fronts. One of the most egregious failures is the Board’s inaction in the face of what we believe to be well-documented violations of MFIN’s own policies and procedures, most of which only came to light through the SEC complaint.⁶ Andrew Murstein put MFIN in a very serious and costly situation and yet MFIN’s public filings/statements seem to downplay the seriousness of the complaint.⁶ In order to show their independence, we believe that the Board should have immediately authorized an independent, outside firm to investigate Andrew Murstein’s actions and if he was in violation, the Board could have considered replacing Andrew Murstein or used its authority under MFIN’s Compensation Recoupment Policy to clawback incentive compensation in the event of an “officer’s detrimental conduct.” Instead the Board spent millions of dollars fighting an expensive, ongoing legal battle with the SEC.

Q10. But profits were up in 2021 through 2023, what seems to be the problem?

Yes. Profits were up in 2021 through 2023. But they were not up due to improved profit margins and returns in the company’s core businesses. The answer is more complicated. 2021 was a good year for most lenders because rates were near record lows. Consumers were flush with cash and so defaults and charge-offs were at all-time lows. However, as rates rose in 2022 and 2023, MFIN made less money in its core business because:

The interest it charged on its loans stayed about the same but the interest it paid on its CDs and its debt increased;

Its borrowers started to struggle to make payments which meant MFIN had to reserve more for future losses and had to charge-off more loans;

There were non-recurring Taxi Medallion loan recoveries that padded its profits and disguised down-trending core performance.⁹.

As you can see from the graphs below, Taxi Medallion assets were 0.5% of total assets and yet, mostly due to one-off recoveries, were responsible for 36% of pre-tax operating income in 2023.⁷

Taxi Medallion Assets’ Outsized Contribution to Pre-Tax Operating Profit vs. Core Profits FYE23

% Total Assets

% Operating Profit

Q11. What are Taxi Medallion loan charge-offs and recoveries and why do they matter?

Taxi Medallion loan balances at 12/31/15, right before the huge losses, were ~$650 million or 47% of total loans and were MFIN’s biggest loan category. As more and more borrowers started to default and the values of the taxi medallions that secured the loans plunged, MFIN ended up writing down the loans which caused substantial losses. Eventually MFIN was able to recover a small portion of the money it lost. Those recoveries boosted income, which boosted profits. But they aren’t “core” profits and because they are non-recurring and unpredictable, investors discount them from an organization’s value. MFIN had charged off (net of recoveries) $267 million at 3Q24 or 41% of the original balance.⁸

Net Income & Core Net Income

(Ex. Taxi Medallion impact)

Source: MFIN 10K/10Qs

FIGURE 4: This shows the material impact of non-recurring Taxi Medallion loan recoveries on earnings. CORE earnings declined to $33.6 million (FYE23) from $35.7 million (FYE22). The “noise” from the Taxi Medallion impact (mostly recoveries) increased earnings 22% in 2022 and 65% in 2023.⁹ Footnote 9 has a detailed breakdown of Taxi Medallion adjustments. Net profits were down YOY and sequential QoQ PRECISELY because Taxi Medallion recoveries diminished. MFIN insisted on reporting its “record” performance with the Taxi Medallion impact which distorted performance.

ROAA and Core ROAA

(Ex. Taxi Medallion impact)

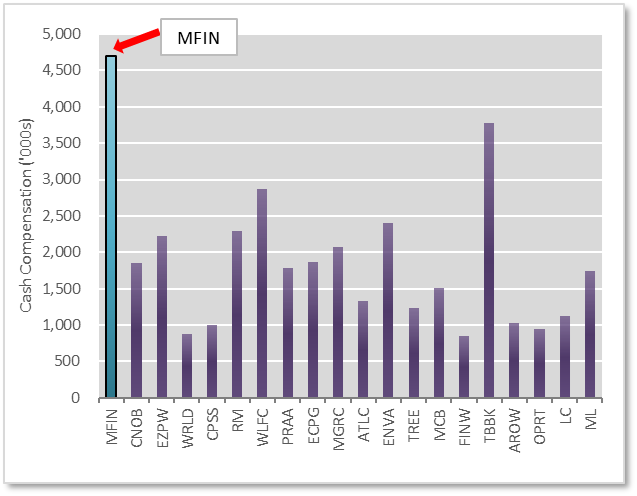

Q12. Do you think management is getting paid too much?

Absolutely. We believe that the compensation of executives at MFIN is much too high and deeply unfair to both shareholders as well as lower-level employees. At FYE23, the top paid 5 employees had total compensation equal to 66% of what the other 164 MFIN employees made. They made 54% in FYE22. Figures 7, 8 and 10 show comparisons to the peer compensation group selected by MFIN. MFIN (Andrew Murstein’s compensation) compares poorly to these proxy peers¹² even though these are not ideal comparisons since these companies are in a variety of businesses that are very different to MFIN. MFIN should be mostly compared to FDIC-insured institutions since 94% of its revenues are generated by its FDIC-insured Medallion Bank subsidiary, the FDIC and Utah DFI regulate Medallion Bank, govern what business lines they can enter, and regulate Medallion Bank’s capital levels and dividend choices (Figure 6 shows comparison banks). MFIN’s performance was much worse against true bank peers and yet Andrew Murstein was paid more than the top paid executives of banks over 30x times larger by assets (see Figure 6 and Figure 9 below) with high capital ratios, consistent profits and consistent returns.¹¹ He is also paid significantly more than the top paid executives at the highest capitalized, top performing $2BN to $5BN asset banks in the country.¹² Our favorite comparison is with Synchrony Financial, a consumer-focused FDIC-insured lender whose President was paid $5.6 million in cash comp in 2023 and $55 million in cumulative total comp. (cash and stock) from 2018-2023 after generating $17.3 billion in cumulative profits from 2018-2023. Mr. Murstein was paid $4.7 million in cash comp in 2023 and $25 million in cumulative total comp. from 2018-2023 after generating only $77 million in profits from 2018-2023¹³. Half the cumulative compensation for 0.44% of the profits….

Source: MFIN 10K/Qs

FIGURE 5: This shows the impact of Taxi Medallion loan recoveries on ROAA, arguably the most important metric. We see that CORE quarterly ROAA has been declining materially over the last 4 quarters to below 1% at 3Q24.⁹ 1Q24 had a slight uptick on ROAA driven by lower than historic core provisions and an unusual “gains on equity investment”. Overall, the downward trend is material and persistent. Footnote 9 has a detailed breakdown of Taxi Medallion adjustments. MFIN’s reported headline ROAA has also declined but still disguises the true extent of the decline in the core business.

CEO Highest Paid Executive Cash Compensation (FYE23)

[Versus Compensation Proxy Peers]

Source: S&P Capital IQ, Companies DEF14A

FIGURE 7: Shows Andrew Murstein’s Cash Compensation versus that of the highest paid executives at 19 public (at FYE23) “compensation peers” that MFIN’s Board used to benchmark compensation.

Mr. Murstein received the highest cash compensation in the peer group. Despite performance (Ex. Taxi Medallion) that was middle to bottom of the peer group (including ROAA, ROAE, Leverage, Price/Tangible Book value).¹³ Companies in the compensation peer group were in industries including: B2B equipment rentals; securitization; marketplace lending; unsecured revolving credit card lending; charge-off collections; or sub-prime focused only. Non of which are comparable to MFIN. Murstein’s compensation is more egregious when compared to FDIC-insured lenders.

Comparison of MFIN compensation vs. highly capitalized top performing $50BN - $100BN Banks & $2BN - $5BN Peer Banks (at FYE23)

Source: S&P Capital IQ, DEF14A, 10K/Q. FYE23 is the most recent compensation data provided by ALL comparable companies.

FIGURE 6: Andrew Murstein, MFIN's President, was paid more in cash compensation than the highest paid executive of every comparison bank except Synchrony Financial which is also 45x larger. Comparison banks were chosen for their top performance metrics.¹² Synchrony Financial was included as a comparison because it is a large, consumer-focused FDIC-insured industrial bank. Compared to banks that are significantly larger/more complex, and banks that are similar in size but more consistently profitable, Mr. Murstein was paid substantially more in cash compensation, total compensation and cumulative 5 year compensation (relative to profits and returns)¹².

Cash Compensation as a % of Net Income [Versus Compensation Proxy Peers]

Source: S&P Capital IQ, Companies DEF14A

FIGURE 8: Shows the CASH compensation paid to Andrew Murstein in FYE23 as a percentage of profits generated for stockholders compared to proxy peers. Mr. Murstein was the 2nd highest paid in FYE23 AND FYE22.

Cash Compensation as a % of Net Income [Versus Top Performing Banks)

Source: S&P Capital IQ, Companies DEF14A

FIGURE 9: Shows the CASH compensation paid to Andrew Murstein in FYE23 as a percentage of profits generated for stockholders compared to top performing peer asset-size banks and large banks. Mr. Murstein was the highest paid in FYE23 AND FYE22. His cash earnings were 4.3x the average of the 6 bank comparisons. Compared to the largest top performing banks (avg assets $93 BILLION compared to $2.6 million for MFIN) Murstein was paid 31x more relative to net earnings.

Cum. Cash Compensation (2018-2023)/Cum. Net Income (2018-2023) [Versus Compensation Proxy Peers]

Source: S&P Capital IQ, Companies DEF14A

FIGURE 10: Shows the cumulative CASH compensation paid to Andrew Murstein from 2018 - 2023 as a percentage of the cumulative net profits to stockholders versus the highest paid executive at compensation peers. It is clear that Mr. Murstein has been paid far more relative to the amount of profit he has generated. He received $0.26 in cash pay for every $1.00 in profit to stockholders.¹³ The proxy peer group averaged $0.04 for every $1 of profit.

Q13. What is the SEC lawsuit about?

The SEC complaint alleges that:

1. Andrew Murstein employed outside contractors to illegally publish supportive articles for MFIN stock/valuation using fake names, and without disclosing their financial reimbursement.

2. Murstein illegally increased the valuation of MFIN’s subsidiary Medallion Bank without any true justification for the increase. The valuation increase helped reduce the negative impact of charge-offs and provisions for future losses as the Taxi Medallion portfolio crumbled. To justify the Bank’s valuation increase, MFIN used valuation multiples from precedent transactions that we have not been able to confirm independently and even though we have asked for evidence since October 2023, MFIN has not provided support for the valuation.

3. Murstein overvalued the taxi medallion collateral and reported false loans-to-values (“LTV”).

As a result, MFIN’s shareholders’ equity was overstated by $140 million at FYE16 and $115 million at FYE17. The SEC “seeks a final judgment: …. (b) ordering Defendants to disgorge any ill-gotten gains they received and to pay prejudgment interest thereon; (c) ordering Defendants to pay civil money penalties…; (d) barring Defendant Murstein from serving as an officer or director of a public company…; and (e) ordering such other and further relief as the Court may deem just and proper.” Therefore, Murstein has every incentive to fight the lawsuit, ironically by using money that would go to shareholders. The Board could have elected not to fight and instead settled, but chose not to.

Q14. Is the SEC lawsuit a big deal?

The SEC lawsuit is a very BIG deal. Anecdotally, it is rare for the SEC to file a lawsuit unless they have very strong evidence. If the SEC wins, MFIN could face material financial penalties due to the alleged behavior of one person: Andrew Murstein. The cost of defending Andrew Murstein and MFIN as a co-defendant is also extremely high running into several million dollars of legal fees. Our estimates are in excess of $7 million.¹⁴ We have asked MFIN for total SEC-related legal expenses, but have been denied. While the SEC lawsuit is pending, very few serious institutional investors are willing to take the risk of investing in MFIN which does not help equity or debt valuations.

Q15. Maybe the SEC lawsuit is a big deal, but didn’t that happen long ago and does it matter now?

The SEC lawsuit revealed 3 huge things that mattered then and matter now. Firstly, they show that Andrew Murstein had (and still has) tremendous influence at MFIN and unilaterally acted in ways that were reckless at best, or according to the SEC claims, illegal at worst, and continue to negatively impact the value of your stock. His decision-making was (and remains) poor and rather than accept the data and focus on loss mitigation, he took the criticism personally and decided to “fight” his critics. Secondly, the SEC lawsuit showed that the then Board was either naïve or incompetent and clearly was not asking the right questions or holding Andrew Murstein accountable. I do not believe that the current Board is incompetent, but they certainly aren’t asking the right questions or holding Mr. Murstein accountable either. Thirdly, Andrew Murstein and MFIN are being accused by the SEC of inflating the Medallion Bank subsidiaries’ value, and that inflated value above book value is still a huge part of MFIN’s balance sheet: recorded as Goodwill and Intangibles. Which means that 50% of MFIN’s equity is essentially “discounted” since it is not related to a tangible asset. However, a Goodwill impairment would have material consequences on the income statement and balance sheet of the company. This is a clear example of how Andrew Murstein’s actions in 2015 to 2018 are still impacting the company in 2023.¹⁵

Q16. Even if losses increase, how bad could it get?

When the Company’s Taxi Medallion assets were struggling from 2016 through 2020, the company’s market cap dropped to $47 million or $1.98/share at 1Q2017 from a peak of $354 million ~3 years before. Market cap dropped to $46 million or $1.86/share at 1Q2020. MFIN is currently trading just above tangible book value but could very easily drop significantly below tangible book value if credit losses continue to increase and investors lose faith in management. To make things worse, as we pointed out in our October 2023 letter/analysis to MFIN, the loss assumptions (which impact their provisions for future losses) being used by MFIN are clearly backward looking and not adapted to the current environment. This is evident by the size of the sequential quarter over quarter increases in the Recreation loans expected loss rate which increased 63bps YTD 3Q24 after increasing 149 bps in 2023.²⁰ Given the SEC investigation, the prior Taxi Medallion loan implosion and a tougher economic environment, investors may panic and run, and hurt the value of all our investments. This is what we want to prevent through this proxy contest.

Q17. But doesn’t MFIN have experience managing through a weaker economic environment?

Not really. Both the size and types of loans the company held during the Global Financial Crisis were different. 15 years ago, Medallion Bank, which held MFIN’s consumer portfolio, only had $199 million in consumer loans (Recreation loans). At FYE2023, Medallion Bank had 10.6x as much or $2.1 billion in both Recreation and Home Improvement loans. During the GFC, annual charge-offs peaked at 5.99% in 2009 which was $12 million annualized, while quarterly charge-offs peaked at 8.27% at 1Q10. Based on 4Q23 consumer charge-off rates annualized, loan charge-offs would total $70 million in 2024, $15 million HIGHER than MFIN’s highest net profit ever in 2023.²¹ These issues can be mitigated with proactive management. MFIN cannot repeat the approach it took to the Taxi Medallion loan crisis.

Q18. Do you believe that Medallion Financial has a bright future?

Yes. Despite all the risks I’ve brought up, we believe that Medallion Bank, MFIN’s largest subsidiary, could be a profitable, enduring business under the right leadership. We feel that MFIN should minimize the distractions of its other non-consumer business lines and focus only on consumer lending and related verticals, which is one reason we began, and continue to incrementally increase our equity position. Our 5 Step plan provides a clear and simple path forward. The bank’s access to FDIC-insured deposits means that funding costs will stay low, which is a huge advantage over competitors. If a professional management team and strong Board can focus on controlling costs, originating good loans, reducing charge-offs and regaining the trust of the investment community, the bank could be in an excellent position to do well in any economic environment and for the long-term.

Footnotes/Citations

1. Source: MFIN DEF 14A

2. Source: S&P Capital IQ

All 10 year stock price changes computed 09/30/14 through 09/30/24. Publicly traded peers included all 205 publicly traded bank stocks with $1 billion to $5 billion in assets as of 3Q24.

3. Source: MFIN DEF14A 2023, S&P Capital IQ

All 10 year returns computed 09/30/14 through 09/30/24.

In its DEF14A 2023, MFIN disclosed the peer group used in its Compensation calculations. Presumably this gives the Board some guidance on reasonable compensation and structure. This group changed over 2022 and 2023, so ZimCal used ALL companies listed as of 2023, 2022 and 2021 which came to 21 comparable companies, of which 1 is no longer public and another went bankrupt as of this analysis and so both were excluded from comparisons. Only 14 of the 20 companies (including MFIN) were publicly traded at 09/30/24 and 09/30/24. The stock price change in each period was calculated for each company that was public at the time and the median return was used. The average is significantly higher.

We believe the Peer comparisons are cherry-picked and inadequate since the companies bear little resemblance to MFIN. However, we included them here for comparison. Reasonable comparisons should consider:

a) Since the Company is at its core a lender dependent almost entirely on spread income rather than fee income, benchmarks should also be primarily lending institutions rather than fee generating business models (e.g. not origination to securitization/sale, or B2B equipment rentals, marketplace platforms, or pawn shop lenders);

b) Since the company has considerable prime exposure in its dominant portfolio and business segments, benchmarks should also have the same prime/sub-prime composition with loans secured by consumer discretionary/real assets (e.g. not unsecured credit cards, or charge-off collections, or only sub-prime focused);

c) Since the Company’s main and only profitable subsidiary is an Utah DFI/FDIC-insured bank with regulators setting strict rules against excessive leverage, limiting up-streamed dividends to the HoldCo and who can approve/disapprove of new business lines, benchmarks institutions should also be mostly FDIC-insured;

d) Benchmarks should be comparable in size (market cap, revenues etc.) to the Company and employ similar leverage with similar risk profiles and earnings volatility.

We believe that FDIC-insured institutions provide the best comparison to MFIN since the regulatory restrictions govern both the way it runs its business, its capital levels and dividend choices. Like MFIN, other FDIC-regulated banks also keep their loans on balance sheet.

4. Source: S&P Capital IQ

Market capitalization of $181 million at 3Q24 versus Tangible Book Value of $192 million at 3Q24. Yields P/TBV = 0.94x

5. Source: MFIN 10K/10Q

There are an abundance of metrics that show the rapid downward trend in the core consumer portfolios, we will show the most glaring. As of 3Q24 and analyzing trends after the peak at FYE21:

Asset Quality:

MFIN’s Recreation loan annualized charge-offs (net) increased 8.0x to 4.34% (1Q24) from 0.53% (4Q21). This is well above the previous cyclical high of 3.80% (4Q19) and could trend toward the GFC high of 5.99% (Annual 2009) but we hope not towards the Annualized quarterly high of 8.27% (1Q10). 2Q and 3Q are seasonal lows for charge-offs and yet 2Q24 and 3Q24 charge-offs are higher than the previous 2Q and 3Q peak in 2019.

Home Improvement loans annualized charge-offs (net) increased 7x to 2.11% (3Q24) from 0.30% (4Q21). This is more than 2.5x the previous cyclical high of 0.83% (4Q19). 2Q24 and 3Q24 are also above previous 2Q and 3Q highs.

We expect increases and decreases quarter to quarter (much like MFIN showed during the GFC) but the yearly trend we expect to get worse.

Period recoveries are also trending down as a % of charge-offs which could indicate a softening secondary market for Recreation collateral.

Capital Ratios:

MFIN’s consolidated leverage ratio declined to 12.6% at 3Q24. It was 15.3% at 4Q21.

Tangible leverage ratio only improved 1.1% to 7.1% at 3Q24 from 6.0% at 4Q21. This is despite record net income in 2022 and 2023. Such a thin tangible capital ratio leaves little room for error and MFIN has not focused on improving it.

Total (expensive) Holding Company indebtedness has increased to $179.5 million (3Q24) from $154 million (4Q21) DESPITE record earnings.

Earnings:

Yields on Recreation and Home Improvement loans have only gone up 40bps and 80bps respectively at 3Q24 since 4Q21, despite 3yr and 5yr treasuries up ~260bps. MFIN has been unable to pass on rate increases, even as its funding costs (mostly CDs) have ALSO increased over 250bps, resulting in a Net Interest squeeze which will continue to weigh on earnings at least through 1H25.

YoY reported Net Income declined 23% and 50% at 3Q24 and 2Q24 respectively. The difference was almost entirely the Taxi Medallion recoveries.

Reported Net Income was $55 million (FYE23) but was skewed by non-recurring, non-core Taxi Medallion asset recoveries – mostly loss provision reversals. These boosted net income by 67%.

Quarterly core ROAA has declined to 1.2% (3Q24) but after adjusting for the Taxi Medallion impact, it fell to 0.94%. This is the true ROAA on MFIN’s core business lines which is down from 4.8% at 4Q21.

On these, and several other ratios, the trends have been downward and concerning.

6. Source original SEC filing, MFIN 10K, MFIN response to SEC filing.

SEC original filing can be found at https://www.sec.gov/litigation/litreleases/lr-25297#:~:text=The%20SEC's%20complaint%20charges%20Murstein,false%20statements%20to%20Medallion's%20auditor.

MFIN’s public statement in response to the filing included, “The actions in question occurred five or more years ago at a time when short sellers were engaged in an online campaign to drive down the Company’s stock price for their personal profit by spreading misleading and disparaging information and misrepresenting its business.” This seems to be us to be an attempt to put in a vacuum the stock decline and short seller connection (since Mr. Murstein certainly would not have been as moved to engage if the stock price had gone up) and omits the obvious which is that the short sellers were mostly right about the risks in the Taxi Medallion, regardless of their methods, or communication tactics. If the Taxi Medallion loans had been well underwritten loans to good borrowers with strong collateral, the short sellers’ antics would have backfired and not impacted MFIN at all in the long-run. ZimCal was heavily involved in bank investing during that period and does not recall, and its research has not revealed, a valuation multiple of the size referenced in MFIN’s 1Q18 10Q in which the Bank was valued at a Price/Tangible Book of 2.25x – 2.50x and a P/E Ratio of 25x-28x. This valuation would also have had to account for a Taxi Medallion loan non-performing loan ratio of 24.1%. Had MFIN received an offer that rich at the time and given its financial trends, they would have been foolish not to sell. In the response referenced above and MFIN’s 10K/Qs, there is an emphasis placed on the time elapsed (five or more years ago), that the activity under investigation was when MFIN was a BDC, and that the third parties have been gone since 2016. All these statements are true, but we feel are somewhat irrelevant as to the ethical nature of Andrew Murstein’s actions. Mr. Murstein made a judgment call that undermined his credibility and fiduciary duties and those doubts persist today. Whether MFIN was a BDC is also completely irrelevant except that subsidiary re-valuations were significantly easier under investment company accounting than under Bank Holding Company accounting.

7. Source: MFIN 10K/Qs, S&P Capital IQ

8. Source: MFIN 10K/Qs 2014 through 3Q24

Taxi Medallion charge-offs (net) were calculated by adding all Taxi Medallion loan “net realized losses” (in BDC accounting terms) held at the Holding Company with all Taxi Medallion loan charge-offs (net) at the Medallion Bank subsidiary through 1Q18 when MFIN converted to Holding Company accounting from BDC accounting. At the BDC to Holding Company conversion at 1Q18, unrealized losses in the entire loan book were converted to realized losses, as the NET loan balance was reflected in the 2Q18 financial statements. As a result, ZimCal estimated 2018 charge-offs by combining realized losses and “unrealized depreciation balance” at 1Q18 with charge-offs (net) at 1Q18 (at the Bank only), and added these to charge-offs (net) on a consolidated basis from 2Q18 through FYE18. This totaled $72 million for the year. Taxi Medallion net realized losses totaled $146.9 million through 1Q18 and $120 million from 2Q18 through 3Q24 for $267 million in total charge-offs (net). Cumulative charge-offs are net of any recoveries.

9. Source: MFIN 10K/Qs

Core performance is the most critical metric to track for any company. Core performance refers to MFIN’s primary revenue generating and ongoing core businesses which does NOT include Taxi Medallion assets. Core business lines are business lines and associated services which represent material and recurring sources of revenue, profit or franchise value for an institution or for a group of which an institution forms part. These future cash flows are what will determine value placed on the enterprise by investors. ZimCal elected to remove Taxi Medallion assets from core performance when they dropped to less than 5% (net) of total assets which occurred at FYE20.

Taxi medallion adjustments consist of taking net income then subtracting Taxi Medallion specific provision reversals, adding repossessed Taxi Medallion collateral write-downs, subtracting gains on sales of foreclosed Taxi Medallions and adding (reversing) the tax impact of the adjustments. At the pre-tax operating income level, the impact of taxes is not relevant. At FYE23, MFIN showed $7.3 million in expenses in its Medallion Segment results ostensibly for managing the remaining $13.7 million in gross Taxi Medallion assets. We believe that expense is ludicrous and inaccurate, especially given that total servicing costs for the $2.1 billion consumer portfolio were $9.5 million (FYE23). Therefore, we do not add those Taxi Medallion expenses back when computing income excluding the Taxi Medallion impact.

10. Source: MFIN DEF14A 2015 – 2022. MFIN 10K/Qs

11. Source: S&P Capital IQ, company DEF14A

Comparison banks were those with $50BN-$100BN in assets that were best capitalized with the highest leverage ratio (>9.5%) and an ROE > 0.75% (closest to MFIN’s ratios). We reasoned that because they were the top performing, large banks with consistent returns and outperforming MFIN, their top executive compensation would be significantly higher than the compensation of Andrew Murstein. We were very, very wrong.

12. Source: MFIN 2022 and 2023 DEF14A. S&P Capital IQ.

Compensation comparisons were made against MFIN’s provided Compensation peer groups from 2022 and 2023 DEF14A which included 21 other companies in a variety of industries most not comparable to MFIN’s consumer lending focus or subject to FDIC regulation. A company that had recently filed for bankruptcy (CURO) and a company (ELVT) that recently went private were excluded (ELVT). MFIN was also compared to the top performing $50BN - $100BN asset banks with the strongest leverage ratio, highest ROAs (leverage ratio>9.50%,ROA>0.75%, Charge-offs (net) <0.50%) - this included Webster Financial, First Horizon and Synchrony Financial was included because of its consumer focus. All the small and large banks were profitable every year over at least the preceding 6 years. MFIN was also compared to 3 of the top 10 performing $2BN - $5BN asset FDIC-insured banks (leverage ratio >13%, ROA>1% and Charge-offs(net) <0.10%) as of the analysis date - this included RBB Bancorp, Parke Bancorp and Baycom Bancorp. MFIN’s top executive compensation was compared to the equivalent at each comp. MFIN ranked poorly on several metrics when compared to the COMP peer group alone at FYE23 including Market Cap (MFIN was 4th smallest), Leverage Ratio (7th worst), Cash Compensation/Net Income (2nd highest paid/worst), and Cumulative Compensation/Total Net Profit (last 6 years) (highest paid/worst). For cumulative totals, the last 6 years were used because that is when MFIN transitioned from investment company accounting to bank holding company accounting and when MFIN acknowledged the full extent of the losses in their Taxi Medallion portfolio. MFIN ranked even worse against top performing large banks ($50BN to $100BN in assets) and top performing small, $2BN-$5BN banks as you can see from the Figures 7 through 10 above.

Cash pay/non-cash pay ratio averaged 75% and 87% for the 2 highest paid executives at MFIN. This has averaged 86% going back to 2015. A higher proportion of stock-based or contingent compensation is typically associated with a better alignment with long-term shareholder interests.

Companies in the compensation peer group were in industries including: B2B equipment rentals; securitization; marketplace lending; unsecured revolving credit card lending; charge-off collections; or sub-prime focused only. We believe these peers are not relevant to MFIN; rather we believe that FDIC-insured institutions provide the best comparison to MFIN since the regulatory restrictions govern both the way it runs its business, its capital levels and dividend choices. Like MFIN, other FDIC-regulated banks also keep their loans on balance sheet.

13.Source: MFIN 10K/Qs, MFIN DEF 14A S&P Capital IQ

14. Source: MFIN 10K/Qs

Professional fees contain the SEC-related legal fees and these totaled $18.9 million in 2022 and 2023. These are significantly above historical averages, and we attributed $7 million of the excess to the SEC affair with an additional $1 million in 2024. ZimCal has asked MFIN repeatedly for a breakdown of legal fees as well as the amounts and limits of Directors and Officers insurance coverage but has been denied.

15. Source: MFIN 10K/Q

Presumably, had the then-Board been asking the right questions, the Taxi Medallion explosion could have been mitigated or avoided. Despite the SEC evidence of Mr. Murstein’s activities, the current Board opted not to hold anyone accountable. Even though Goodwill and Intangibles are by definition not tied to a physical asset value they still meaningfully impacted MFIN’s equity ratios at 3Q24. A Goodwill impairment would have real consequences on the income statement and balance sheet. MFIN management has suggested that the age of the alleged offenses has some bearing on their seriousness but we believe the allegations in the complaint are serious and concerning, and the passage of time has a not lessened their seriousness. A recent denial of almost MFIN/Murstein’s motions to dismiss validates our thinking.

16. Source: SEC complaint

17. Source: New York City Taxi and Limousine Commission

18. Source: S&P Capital IQ

MFIN’s market capitalization shrunk to less than $50 million in 2017, at the peak of the Taxi Medallion implosion, down from over $300 million in 2014.

19. Source: MFIN 10K/Q

Yields on Recreation and Home Improvement loans have only gone up 40bps and 80bps respectively at 3Q24 since 4Q21, despite 3yr and 5yr treasuries up ~260bps. MFIN has been unable to pass on rate increases, even as its funding costs (mostly CDs) have ALSO increased over 250bps, resulting in a Net Interest squeeze which will continue to weigh on earnings at least through 1H25.

20. Medallion Bank 10K/Q

21. Source: MFIN 10K/Q.

Based on a consumer loan (Recreation and Home Improvement) 1Q24 charge-off rate of 3.54% which is $74 million annualized. This is 49 bps above the most recent cyclical peak in 4Q19.