We believe that Medallion Financial Corp. has tremendous

potential which can be reached through 5 simple steps:

1

2

3

4

5

See our most recent 35-page 5 Steps to Improvement white paper we gave to MFIN in 2024. A summary of the 5 Steps is included below. The updated white paper also includes MFIN’s detail-lacking objections to the benefit of the original plan⁹, likely driven by a desire to protect its COO and executives, so you can judge the inadequacy of their response for yourself.

As MFIN so eloquently stated in its May 24th, 2024 letter to its stockholders: “[ZimCal’s] five-step plan” has no actionable benefits for the Company. No change is needed and based on [its] statements [ZimCal] would only bring negative change that could derail the Company’s continued value creation”. MFIN then proceeded to follow exactly what ZimCal recommended in Step 2 and finally resolved the SEC complaint after most of their motion to dismiss was predictably denied. MFIN has also parroted our language about technology and tried to implement other ideas we recommended over 2 years ago.

The original 5 Steps to Improvement plan can be accessed here.

Enhance the Board of Directors

1

Remove family control of the Board and add new directors with relevant experience that overlaps with the Company’s core strategy, who will answer to shareholders, and hold management accountable.

See detailed “5 Steps to Improvement” white paper.

The Board needs fresh ideas and directors who are unafraid to challenge the status quo. The average involvement of the current Board members with either MFIN or Medallion Bank is 17.5 years. 5 of 8 Board members are older than 77 years old. There should be a mandatory retirement age and term limits to promote fresh ideas.

The Board needs directors with current experience in consumer lending, capital markets, banking, business/business-line start-ups, credit analysis, risk management and asset-backed securitizations. All areas of consumer finance that impact MFIN meaningfully.

MFIN should eliminate what we see as effective control of the Board by the Murstein family and enhance true Board independence. 3 of 8 Board members including the Board Chair and MFIN’s President are Murstein family members. The lead “independent” director was with Medallion Bank for 19 years before joining MFIN’s Board. The Chairperson and CEO roles, held by Alvin Murstein, should be separated.

The Board should appoint an independent, reputable outside firm (to avoid conflicts of interest) and analyze Andrew Murstein’s behavior as outlined in the SEC complaint for what we believe to be clear violations of the Company’s internal controls and procedures, including its Code of Ethics.

The Board should select proxy peer companies that have similar businesses, risk profiles, regulatory oversight and capital structures so that executive compensation can be accurately compared.

The Board should review and right-size Mr. Murstein’s compensation structures to better reflect the size (and earnings) of the Company, reflect MFIN’s financial performance and better align with stockholders.

The Board’s should take its risk management oversight role seriously by demanding full transparency and detailed reporting into the deteriorating credit quality in the consumer loan portfolio¹, specifically the subprime Recreation portfolio, in order to proactively mitigate risk.

The Board structure should be declassified such that ALL Directors are up for re-election annually rather than classified (staggered) which results in only 2 or 3 Directors up for re-election annually. This is far more shareholder friendly, allows for immediate accountability and prevents entrenched management.

The Bylaws should be changed to give more power to independent stockholders and less to entrenched insiders. For example, Bylaw changes currently need a 75% super majority. With insider ownership above 25%, that effectively means management and the Mursteins' can block any changes that the majority of stockholders might want. ZimCal’s recommended shareholder (rather than management) friendly changes are outlined in detail here and would result in strong institutional support.

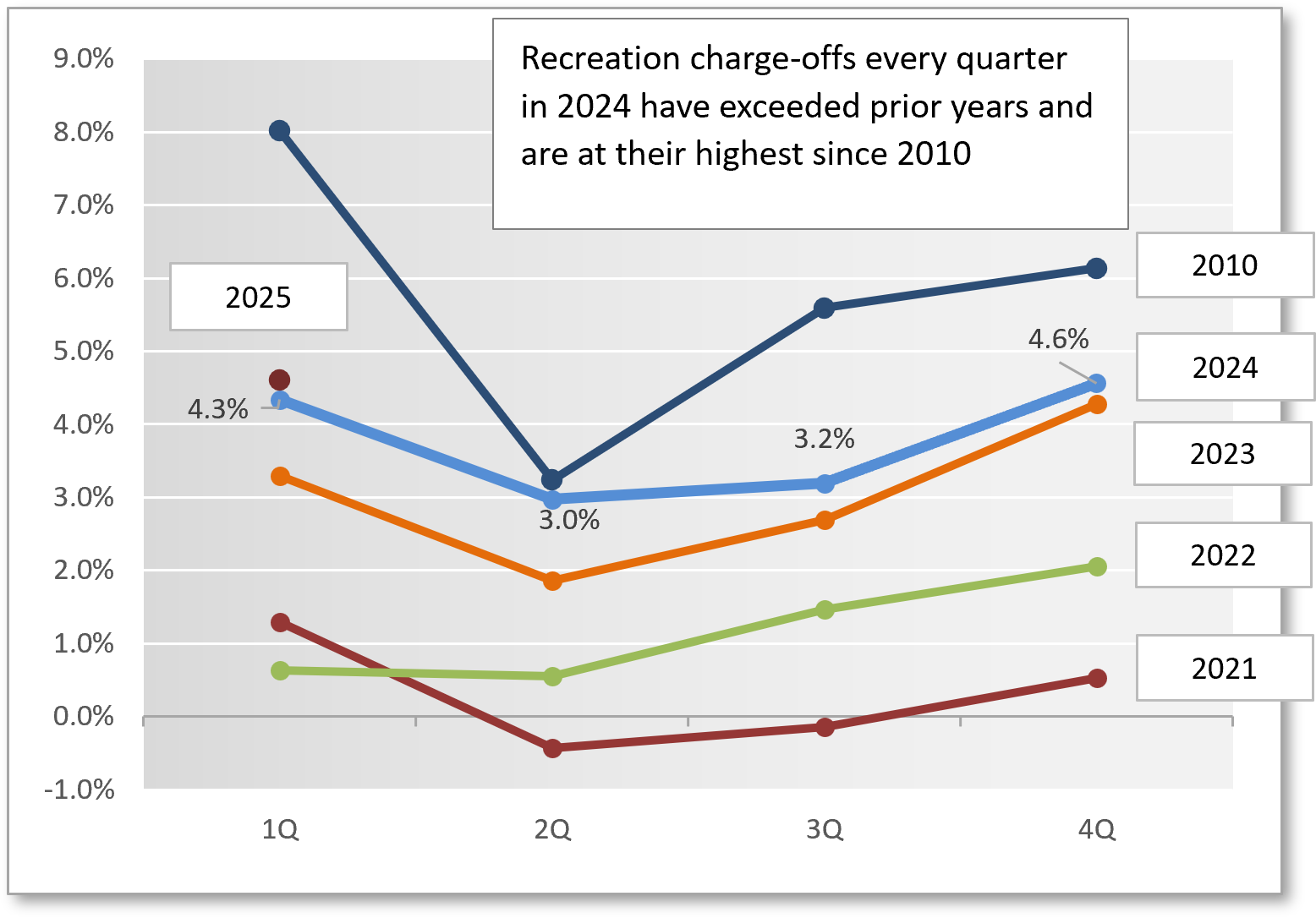

(Recreation is approx. 60% of Total Loans)

Recreation charge-offs (net) by Quarter

Source: MFIN 10K/Qs

FIGURE 1: Recreation charge-offs are at their highest levels for each quarter since 2010. We predicted, and MFIN had, further deterioration in 4Q24 and 1Q25. At 1Q25 Recreation balances were $1.5 billion but were only $195 million at 4Q10. The risks now are much bigger.

Resolve the SEC Complaint

2

Murstein was charged with fraud and lying by the SEC. we had been URGING MFIN to resolve it since 2023. When Murstein and MFIN’s motions to dismiss were denied and the case was heading to trial, the defendants finally settled for $4 milllion. The SEC findings and accusations make it impossible for discerning investors to trust MFIN or Murstein as it revealed devastating details on internal failures and ethical conduct.

See detailed “5 Steps to Improvement” white paper.

Even though the SEC complaint was resolved, there was absolutely no accountability despite Murstein’s unilateral actions. We do not trust Murstein’s business judgment and do not believe the board has the courage to hold him accountable for this or any future actions.

MFIN tried to minimize the seriousness of the SEC investigation through public disclosures; we believed that the SEC allegations should not have been minimized² and we were correct. Judge Lewis Kaplan’s denial of the motion to dismiss was devastating for Murstein and MFIN.

Mr. Murstein’s unilateral actions are what led to the lawsuit, and yet his legal defense was paid for by shareholders. The expenses of defending MFIN and Andrew Murstein have been significant and estimated at ~$8.5 million (through 2Q24) and MFIN paid an SEC fine of $3 million. MFIN’s insurance covered $5.5 million, leaving stockholders’ on the hook for an estimated $6 million.

The SEC lawsuit was a massive internal distraction at a time when management and the Board needed to focus on thriving in a rapidly changing economic environment.

Improve Management

3

Bring in a professional, slimmed down management team that has credibility with investors and can guide the company to long-term success.

See detailed “5 Steps to Improvement” white paper.

Management must focus on (and be rewarded for) improving core performance and should isolate the earnings noise from Taxi Medallion assets which are all non-core. Earnings are much worse than reported when Taxi Medallion impacts are removed. Management was awarded record bonuses DESPITE a decline in MFIN’s core business and a weak stock price.

A lack of trust by investors in MFIN’s leadership will cap MFIN’s stock valuation and will not maximize returns to shareholders and stakeholders over the long-term. This could also jeopardize continued inclusion in the Russell 3000. A professional management team should be brought in.

The lack of management credibility will severely restrict access to capital or make it punitively expensive and prevent MFIN from taking advantage of future opportunities.

Management (and the Board) must address MFIN’s sub-optimal capital structure which has expensive legacy preferred equity that is structurally senior to ALL debt, and reduce expensive debt that was raised to fund holding company operating losses.

MFIN must right-size the entire executive management teams’ size and align its compensation structure to better align with peer companies and stockholder interests. MFIN must reduce the size of the executive team to reflect the lack of complexity and small balance sheet of MFIN. 3 Presidents, 2 CFOs and a CEO on the executive team are excessive for a $2.6 billion asset lender.³

Murstein’s compensation alone ($6.5 million in 2023) would pay for an entire team of top-quality executives and allow for a generous contingent bonus package tied to stock appreciation, credit quality, improved core ROAA and long-term value creation.

MFIN’s President made some catastrophically bad decisions in the last crisis (as outlined in the SEC complaint) and the Company needs a leader who will be able to lead through the next crisis. The cyclical nature of consumer lending means that there is likely to be one in the future.

We believe that current leadership has shown that it can be driven by emotion rather than facts, which could exacerbate a future crisis and is a liability. This was evident during the Medallion loan implosion where MFIN dismissed various news articles (Bloomberg, Vox) and short sellers who identified the huge risks 2 to 3 years before the implosion of MFIN’s Taxi Medallion loan portfolio⁴. We believe that regardless of the source, the data should never be ignored.

Management must use forward looking data and not unduly rely on backward looking data. “Check the box” risk disclosures are useless without mitigating action.

We believe that MFIN needs a leader that understands their responsibility to stockholders. The detailed evidence in the SEC complaint revealed disturbing insights into Murstein’s sense of fiduciary responsibility.

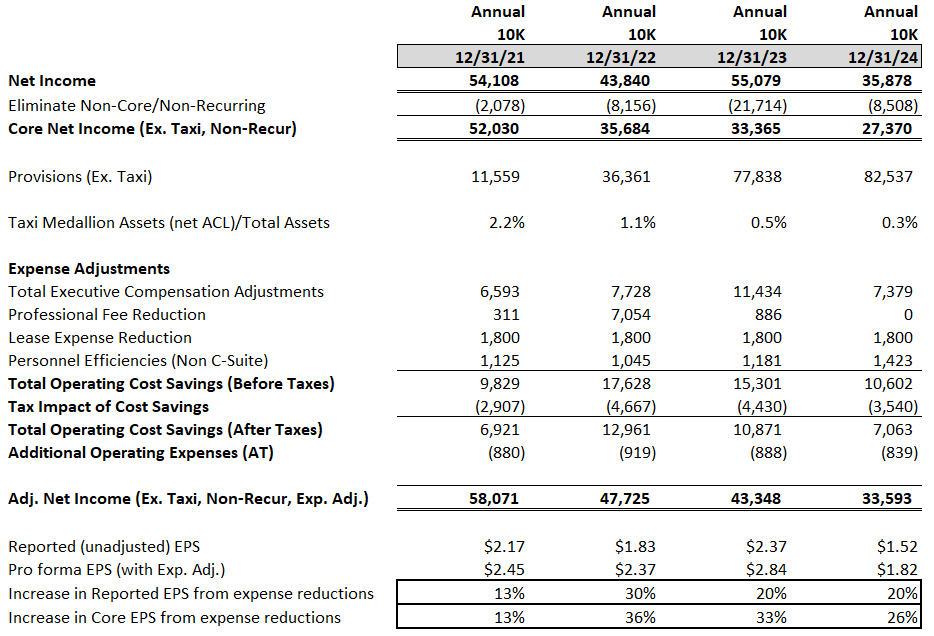

Core net income and provisioning (Ex. Taxi Medallion) versus unadjusted net income

Source: Company 10K/Q

FIGURE 2: This shows the adjustments to reported earnings to remove the Taxi Medallion impact. Core net income (Ex. Taxi Medallion) has declined every year since the peak at FYE21. 1Q25 core net income was an anomalous improvement over 4Q24 core net income. While the 1Q25 headline core net income trend appeared positive, 1Q25 core net income was boosted by an irregular “gain on equity” of $9.4MM which was 45% of operating profit. While we applaud the gains, it cannot distract from the weak consumer business which is 95% of total loans.

Cut Expenses

4

Reduce unnecessary expenses to increase profits to shareholders and to be better prepared for a possible economic slowdown and/or lower consumer demand. Operating efficiencies will be critical in a down-cycle.

See detailed “5 Steps to Improvement” white paper.

Reduce operating expenses and debt service at the holding company level⁵, with a focus on reducing executive compensation to appropriate levels as outlined in Step 3 above. We estimate right-sized executive compensation alone would have saved MFIN ~$33 million in expenses before taxes from 2021-2024.³

Make bonus goals difficult to reach and weighted towards sustainable improvements. Make compensation 50/50 weighted with CONTINGENT stock or stock options and cash. This would dramatically reduce bonus payments/expenses unless MFIN outperformed.

MFIN finally following ZimCal’s direction and settling the SEC lawsuit has avoided substantial future legal fees and what might have been a huge jury-awarded penalty.

Eliminate or severely reduce the Holding Company’s Manhattan lease and footprint. MFIN has no major business lines in Manhattan and yet the Manhattan lease costs MFIN $1.8 million/year. Medallion Bank employs 4x as many people as the Holding Company, is 95% of consolidated revenues and yet its lease is only $550,000/year⁶.

Focus on personnel cost efficiencies with a plan to control and limit collection and servicing costs that totaled $17 million in FYE24 and $15.5 million in FYE23, while improving outcomes.

Earnings and EPS (pro forma) impact of expense reductions - historical and projected

Source: S&P Capital IQ, MFIN 10K/Qs

FIGURE 3: As the table shows, Expense reductions would have resulted in significantly higher core pro forma Net Income/EPS increasing EPS by an average of 27% over the last 4 years. Even unadjusted, reported EPS would have increased by an average of 20%

Go on Offense

5

Make technology the #1 focus. Get rid of distractions and focus on the core lending business so that MFIN can better compete in an ultra-competitive consumer lending environment. MORE

See detailed “5 Steps to Improvement” white paper.

Meaningfully invest in technology to boost productivity, analyze underwriting methodologies and loss mitigation which will allow the Company to iterate and improve. Make technology a core pillar of future success and designate a CTO (or similar role). Competitors are investing heavily in tech.

Reduce subprime originations in the near-term until (subprime) consumer health trends are clearer. Minimizing potential subprime pain will allow the Company to compete aggressively once headwinds disappear.

MFIN must actually tighten underwriting standards beyond superficial (and minimal) FICO increases. E.g. advance rates, debt-to-income, loan maturities, collateral age could all be altered to improve underwriting.

Develop or acquire a servicing platform to capture real-time customer data to both improve operations and get better servicing outcomes that reduce delinquencies and charge-offs, rather than outsourcing consumer loan servicing and collections, as is currently done. This could also lead to fee-generating, servicing retained opportunities. Heightened loan stress in a “new normal” economy means servicing and collections must be a core competency for any consumer lender.

Improve internal and external disclosures to hold management accountable, enhance investor confidence and earn investor support for future initiatives.

Reduce or exit existing less profitable business lines that do not leverage the Company’s core competencies in the consumer lending business.⁷ These are needless distractions, and the competitive and dynamic⁸ nature of consumer lending requires all management’s attention.

Have the Holding Company be a source of strength rather than a source of weakness to the Bank. Substantial Holding Company expenses and debt service add additional risk in a downturn due to the Holding Company-Bank subsidiary structure.⁵ This also increases regulatory scrutiny.

Reduce the reliance on spread income and focus on increasing fee income. This will act as a counterbalance to interest rate uncertainty, NIM compression and consumer demand cyclicality.

Pursue new consumer lending lines of business that build on core skills and recognize the limits of banking-as-a-service for Fintech loan originators.

Footnotes/Citations

1. Source: MFIN 10K/10Q

There are an abundance of metrics that show the rapid downward trend in the core consumer portfolios, we will show the most glaring. As of 3Q24 and using 2 year trends (after the peak at FYE21)

Asset Quality:

MFIN’s Recreation loan annualized charge-offs (net) increased 8.0x to 4.34% (1Q24) from 0.53% (4Q21). This is well above the previous cyclical high of 3.80% (4Q19) and could trend toward the GFC high of 5.99% (Annual 2009) but we hope not towards the Annualized quarterly high of 8.27% (1Q10). 2Q and 3Q are seasonal lows for charge-offs and yet 2Q24 and 3Q24 charge-offs are higher than the previous 2Q and 3Q peak in 2019.

Home Improvement loans annualized charge-offs (net) increased 7x to 2.11% (3Q24) from 0.30% (4Q21). This is more than 2.5x the previous cyclical high of 0.83% (4Q19). 2Q24 and 3Q24 are also above previous 2Q and 3Q highs.

We expect increases and decreases quarter to quarter (much like MFIN showed during the GFC) but the yearly trend we expect to get worse.

Period recoveries are also trending down as a % of charge-offs which could indicate a softening secondary market for Recreation collateral.

Capital Ratios:

MFIN’s consolidated leverage ratio declined to 12.6% at 3Q24. It was 15.3% at 4Q21.

Tangible leverage ratio only improved 1.1% to 7.1% at 3Q24 from 6.0% at 4Q21. This is despite record net income in 2022 and 2023. Such a thin tangible capital ratio leaves little room for error and MFIN has not focused on improving it.

Total (expensive) Holding Company indebtedness has increased to $179.5 million (3Q24) from $154 million (4Q21) DESPITE record earnings.

Earnings:

Yields on Recreation and Home Improvement loans have only gone up 40bps and 80bps respectively at 3Q24 since 4Q21, despite 3yr and 5yr treasuries up ~260bps. MFIN has been unable to pass on rate increases, even as its funding costs (mostly CDs) have ALSO increased over 250bps, resulting in a Net Interest squeeze which will continue to weigh on earnings at least through 1H25.

YoY reported Net Income declined 23% and 50% at 3Q24 and 2Q24 respectively. The difference was almost entirely the Taxi Medallion recoveries.

Reported Net Income was $55 million (FYE23) but was skewed by non-recurring, non-core Taxi Medallion asset recoveries – mostly loss provision reversals. These boosted net income by 67%.

Quarterly core ROAA has declined to 1.2% (3Q24) but after adjusting for the Taxi Medallion impact, it fell to 0.94%. This is the true ROAA on MFIN’s core business lines which is down from 4.8% at 4Q21.

On these, and several other ratios, the trends have been downward and concerning.

2. Source original SEC filing, MFIN 10K, MFIN response to SEC filing.

SEC original filing can be found at https://www.sec.gov/litigation/litreleases/lr-25297#:~:text=The%20SEC's%20complaint%20charges%20Murstein,false%20statements%20to%20Medallion's%20auditor.

MFIN’s public statement in response to the filing included, “The actions in question occurred five or more years ago at a time when short sellers were engaged in an online campaign to drive down the Company’s stock price for their personal profit by spreading misleading and disparaging information and misrepresenting its business.” This seems to be us to be an attempt to put in a vacuum the stock decline and short seller connection (since Mr. Murstein certainly would not have been as moved to engage if the stock price had gone up) and omits the obvious which is that the short sellers were mostly right about the risks in the Taxi Medallion, regardless of their methods, or communication tactics. If the Taxi Medallion loans had been well underwritten loans to good borrowers with strong collateral, the short sellers’ antics would have backfired and not impacted MFIN at all in the long-run. ZimCal was heavily involved in bank investing during that period and does not recall, and its research has not revealed, a valuation multiple of the size referenced in MFIN’s 1Q18 10Q in which the Bank was valued at a Price/Tangible Book of 2.25x – 2.50x and a P/E Ratio of 25x-28x. This valuation would also have had to account for a Taxi Medallion loan non-performing loan ratio of 24.1%. Had MFIN received an offer that rich at the time and given its financial trends, they would have been foolish not to sell. In the response referenced above and MFIN’s 10K/Qs, there is an emphasis placed on the time elapsed (five or more years ago), that the activity under investigation was when MFIN was a BDC, and that the third parties have been gone since 2016. All these statements are true, but we feel are somewhat irrelevant as to the ethical nature of Andrew Murstein’s actions. Mr. Murstein made a judgment call that undermined his credibility and fiduciary duties and those doubts persist today. Whether MFIN was a BDC is also completely irrelevant except that subsidiary re-valuations (which provided a major earnings boost) were significantly easier under investment company accounting than under Bank Holding Company accounting.

3. Source: MFIN DEF14A. S&P Capital IQ.

ZimCal estimated that executive compensation could have been reduced by $33 million (net) over 2021-2024. These savings would have flowed directly through to stockholders. Executive roles are disclosed in company filings. Estimated savings in executive salaries primarily based on emulating the commercial bank/bank holding company model in which bank executives carry dual roles at both entities and almost all major personnel and other expenses are run through the bank. Expensed executive compensation (including stock-based comp) was estimated at $10.5 million, $13.4 million, $9.7 million and $9.1 million estimated at FYE24, FYE23, FYE22 and FYE21 respectively, which ZimCal right-sized to $2.5 million/annum. Note that $2.5 million is still a considerable amount for the executive teams of FDIC-insured lenders. See here for more details on MFIN compensation versus peer companies.

4. See FAQ “Q15. Wasn’t the drop in MFIN’s value back in 2015 – 2018 due to short sellers?”.

5. Source: MFIN 10K/Q. Capital IQ.

For context, FYE23, we estimated Holding Company debt service would be ~$14 million over the next 12 months and HC operating expenses were ~$20 million in 2023. This meant that the Bank had to be sufficiently profitable to upstream ~$25-$30 million in 2024 to cover expenses and debt service and this was after paying any Bank preferred equity dividends ($6 million in 2023). The Bank had only made an annual profit greater than $30 million 3 times in the last 10 years, in 2021-2023, which was during unprecedented fiscal and monetary stimulus and with the aforementioned (see FAQ) non-recurring and non-core Taxi Medallion recoveries. As we predicted, MFIN had to raise money and raised $10 million in debt in 2024 to fund shortfalls and maintain the minimum capital ratio at the Bank. Importantly, although the Bank is currently compliant with the 2003 FDIC capital maintenance agreement entered into by the Bank that mandates a minimum 15% Tier 1 Leverage ratio, that could change if asset quality deteriorates. FDIC-insured institutions can also have additional distribution restrictions placed on them by regulators that are typically tied to profitability and asset quality, regardless of the Leverage ratio. If future asset quality issues exceed expectations and credit loss reserves, and/or a sustained period of higher funding costs lowers NIM, the 1% margin above the 15% minimum would disappear instantly, impacting dividends available to the Holding Company, possibly in the midst of a highly uncertain and risk-averse capital raising environment.

6. Source: Eleventh & Tenth Amendment to Agreement of Lease - Property Group Utah and Medallion Bank, a Utah Industrial Bank, Second Amendment of Lease dtd 08/15/15 - Sage Realty and Medallion Financial Corp.

7. Source: MFIN 10K/Qs.

MFIN has historically been involved in a diverse range of businesses that, in most cases, did not last or did not consistently increase profitability or returns. A majority of these businesses had very little overlap with MFIN’s core businesses and, in our opinion, were an unnecessary distraction for management. We also believe that allowing this number of divergences from the core business is another failure of governance and inefficient allocation of resources. Businesses MFIN was involved in include: Medallion Fine Art, Inc.; Medallion Taxi Media, Inc. (media/advertising on taxis); and RPAC Racing, LLC (NASCAR); LAX Group LLC (involved in holding an equity investment in a professional lacrosse team); Medallion Consulting Services (providing general consulting services); CDI-LP Holdings (focused on holding and managing equity investments in a racing team, an equipment manufacturing business, and an airport and food retail business); Medallion Motorsports LLC (a subsidiary of CDI-LP Holdings holding an equity investment in a racing team); Generation Outdoor Inc. (engaged in out-of-home media planning and buying); Medallion Hamptons Holdings LLC (formed to hold and manage a hotel investment); Medallion Sports Media (involved in sports advertising and sponsorship services).

8. Competition in both Recreation and Home Improvement lending is fierce,

Competitors include: specialty finance companies, fintech intermediaries, marketplace lenders, aggregators for loan sales/securitization vehicles, commercial banks and various credit unions. Some of the widely used marketplace lending sites both provide loans a platform for and compete with the Company. As an indirect lender without any direct borrower relationships, the Company cannot easily distinguish itself from other lenders and thus charge more for its services. In short, the Home Improvement borrowers, Recreation borrowers, and their referral sources are commoditized, transactional relationships and options are plentiful, particularly in the prime lending space. This puts pressure on interest income. The rapid technological changes of incumbents and new entrants into the Recreation lending space will also have a meaningful impact on spread income. Nimble lending competitors that rely on high productivity and lowered transaction and servicing costs will put an effective “cap” on loan yields and will push other lenders searching for yield and originations to loosen standards or push further down the credit spectrum. However, MFIN has a huge advantage. Its stable and cheap FDIC-insured deposits and simple, indirect lending approach means that, relative to its competitors, it can more easily focus on operating improvements and therefore, expanded margins and profits.

9. Source: Medallion Financial Corp. Investor Presentation May 2024 and multiple shareholder letters send between April and June 2024